30+ Mortgage comparison calculator

The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive. Loans Comparison Calculator Use Our Loan Comparison Calculator To Compare Payments and Costs with up to 3 Loans.

Snohomish County Housing Market Remains Resilient In August 2022

With a shorter 15 year mortgage you will pay significantly less interest than a 30.

. Decide which is best for you. Use this calculator to. Request a Mortgage Consultation - more information about 15- vs.

Determining which mortgage term is right for you can be a challenge. Assuming you would take the full 30 year term to pay off the first loan you would. Theres a huge difference between a 15-year and 30-year mortgage and figuring out which is best for you can be a challenge.

Use our mortgage comparison calculator to evaluate the pros and cons of two loans. The Mortgage Comparison Calculator from Credit Union ONE can help you compare a 15 year mortgage term vs. If you want to customize the colors size and more to better fit your site then.

Last week the average rate was 442. Your monthly payment for the 30 year loan would be 141947. Enter your expected mortgage.

For today Friday September 09 2022 the current average rate for the benchmark 30-year fixed mortgage is 608 increasing 13 basis points compared to this time last week. Estimate The Home Price You Can Afford Using Income And Other Information. Use this mortgage cost calculator to compare mortgage payments between a 15 and 30 year fixed mortgage.

Compare Quotes Now from Top Lenders. 1 day agoPaying a 25 higher down payment would save you 891608 on interest charges. With a shorter 15 year mortgage you will pay significantly less interest than a 30 year mortgage - but only if you can.

1 day agoCompare how different interest rates affect the cost of your mortgage. 30-year fixed mortgage rates. Ad Work with One of Our Specialists to Save You More Money Today.

Ad Find Mortgage Lenders Suitable for Your Budget. With a shorter 15-year mortgage you will pay significantly less. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Determining which mortgage term is right for you can be a challenge. 51 Adjustable-Rate Mortgage Rates. A 30 year term.

Lowering the interest rate by 1 would save you 5156203. Paying an additional 500 each. 5 hours agoThe average rate on a 30-year fixed mortgage jumped by 004 in the last week to 618.

Compare Quotes See What You Could Save. Compare loan terms interest rates monthly payments and total cost of the loans. Get Your Best Interest Rate for Your Mortgage Loan.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. 30-Year Mortgage Comparison Calculator Apply Now - more information about 15- vs. Currently the average interest rate on a 51 ARM is 453 up from the 52-week low of 411.

The 15 year vs 30 year mortgage comparison calculator exactly as you see it above is 100 free for you to use. The current average 30-year fixed mortgage rate is 566 according to Freddie Mac. The 15 year loan will cost you 487 more monthly and save you 100188 in total interest compared to the 30 year loan.

Rates for a 30-year mortgage refinance fell slightly today giving homeowners who want a longer repayment term an opportunity to save on interestMeanwhile. For the 15 year loan it would be 180872. 3 hours agoWhat this means.

View all Loan Calculators. Carys Mills and Mathilde Augustin. The calculator will also create an amortization table for both the 15- and 30-year loans so you can do a side-by-side comparison of how fast youll pay the loan down on each and what your.

Ad Our Calculators And Resources Can Help You Make The Right Decision. Published September 7 2022 Updated Yesterday. With a 30-year fixed-rate loan your monthly payment is 125808.

Determining which mortgage term is right for you can be a challenge. With a shorter 15 year mortgage you will pay significantly less interest than a 30 year. Use Bankrates loan comparison calculator to get a clear picture of all relevant costs.

This is an increase from last week when it was at 555. Meanwhile the average rate on a 15-year fixed mortgage climbed 004 during the.

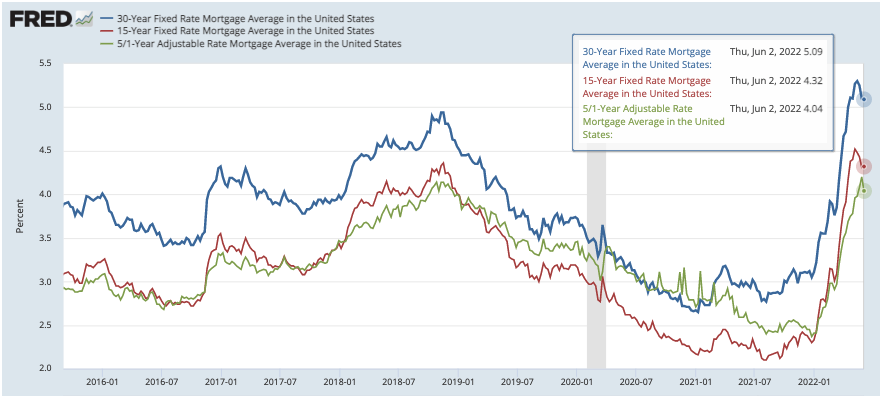

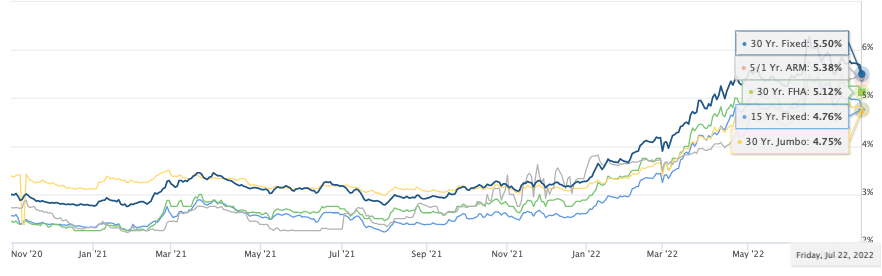

St Louis Interest Rates St Louis Real Estate News

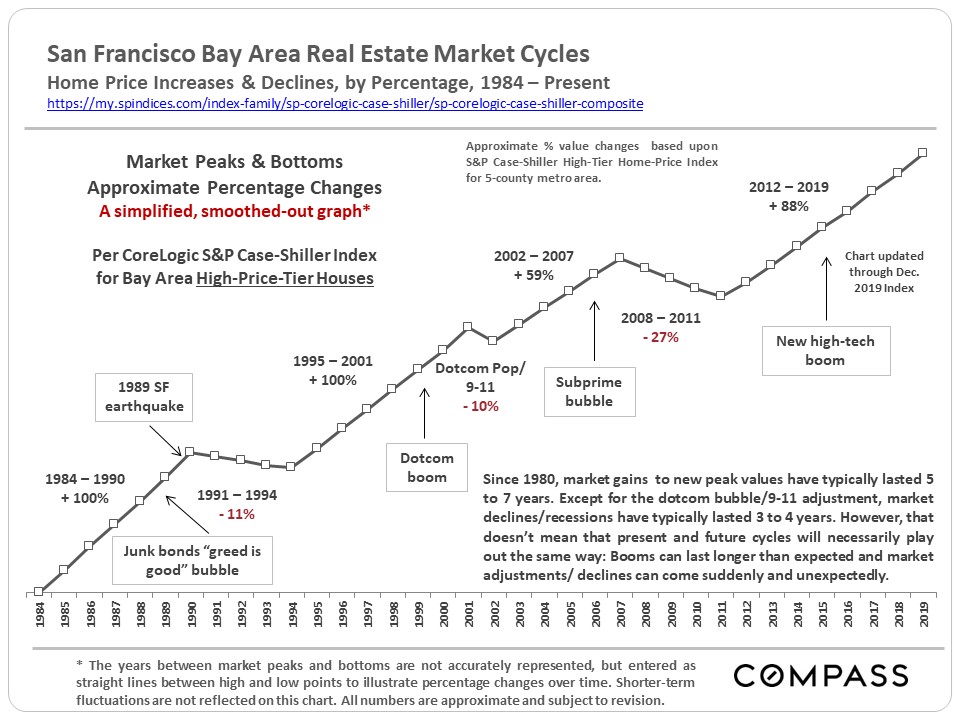

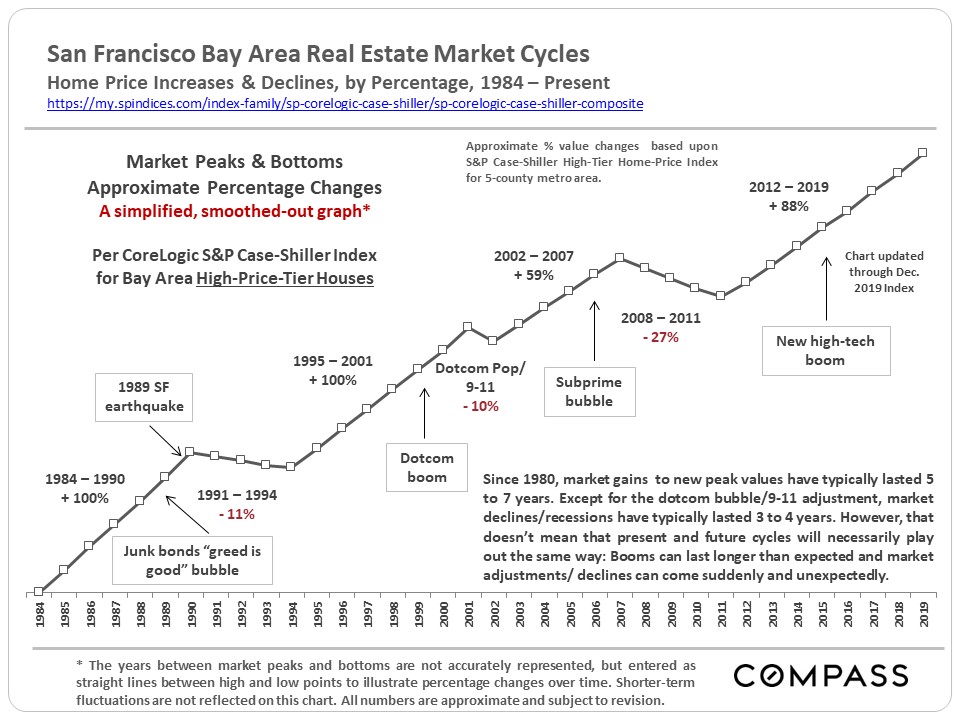

Recessions Recoveries Bubbles 30 Years Of Housing Market Cycles In San Francisco Marin Home Team Paragon Real Estate

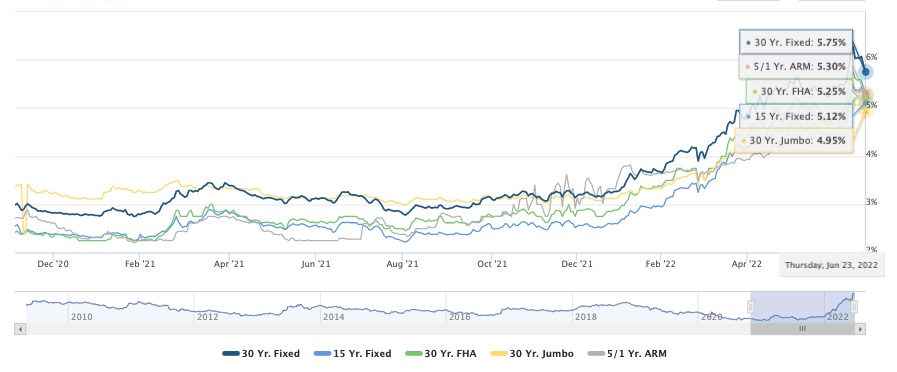

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

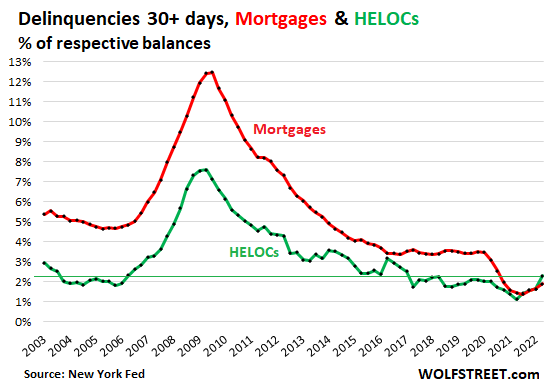

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

30 Years Of Bay Area Real Estate Cycles Compass Compass

St Louis Interest Rates St Louis Real Estate News

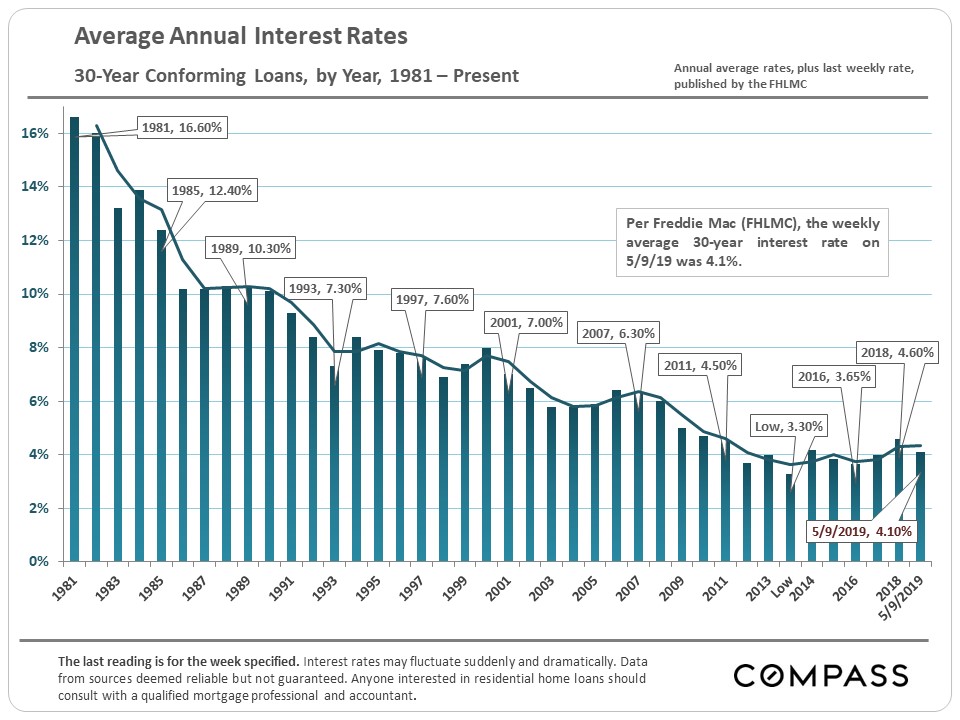

Why Are Interest Rates So Low

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

30 Years Of Bay Area Real Estate Cycles Compass Compass

St Louis Interest Rates St Louis Real Estate News

St Louis Interest Rates St Louis Real Estate News

30 Years Of San Francisco Bay Area Real Estate Cycles

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Was Getting An Arm Before Inflation And Rates Went Up A Bad Move

30 Years Of Housing Market Cycles In The San Francisco Bay Area Investsf