20+ Dti ratio calculator

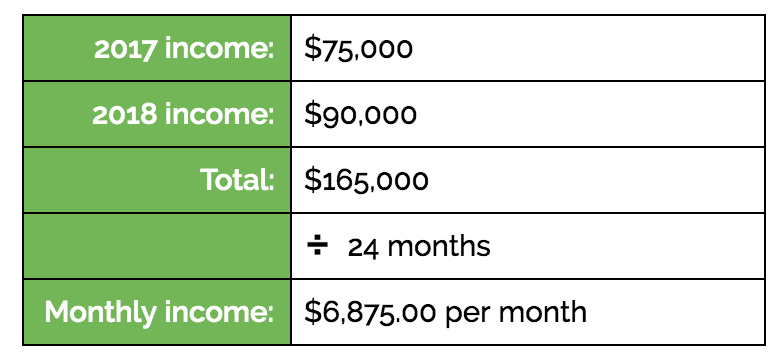

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Usable income depends on how you get paid and whether you are salaried or self-employed.

Everything About Debt To Income Ratio And How To Calculate It

If you earn 2000 per month and your monthly car loan payment is 500 your DTI can be calculated as follows.

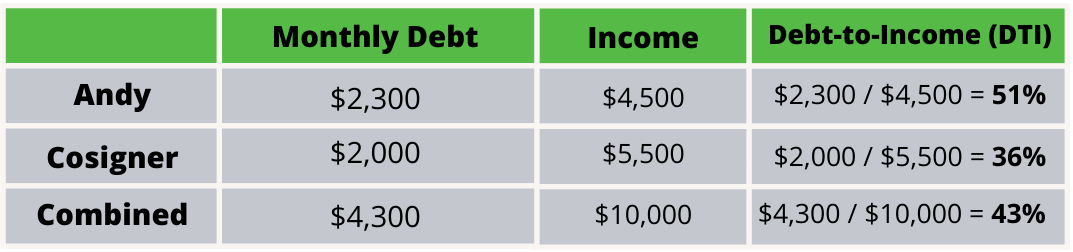

. Lenders prefer to see a debt-to-income ratio. The debt-to-income DTI ratio is a key financial metric that lets lenders know how much of a borrowers monthly gross income goes into paying off their current debt. Debt to income ratio - what is it.

Expressed as a percentage a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income. It is calculated by adding up your total monthly bills such as your credit card debt payments. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall income.

Subtract your monthly debts from your monthly gross income your take-home pay before taxes and other monthly. Debt-To-Income Ratio - DTI. The following calculator provides the Debt to Income DTI ratio which measures the percentage of gross monthly income that goes towards monthly debt and interest repayments.

DTI debt income 100. Use our debt-to-income calculator that considers your annual and monthly income and expenses to determine your debt-to-income ratio DTI one of the qualifying factors by lenders to. Payments on any other debts that appear on your credit report.

Your debt-to-income ratio is a great way to look at how financially healthy you are basically. 500 2000 100 25. Click the Calculate DTI Ratio button to see the results.

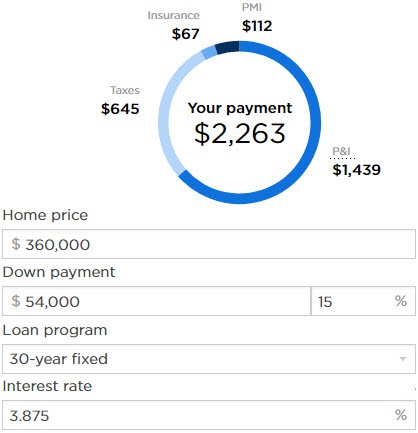

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. The back-end DTI ratio shows the income percentage covering all your monthly debts. VA guidelines on debt-to-income ratio requirements mandate a maximum debt-to-income ratio of 31 front-end and 43 back-end for borrowers with under 580 FICO and down to 500 credit.

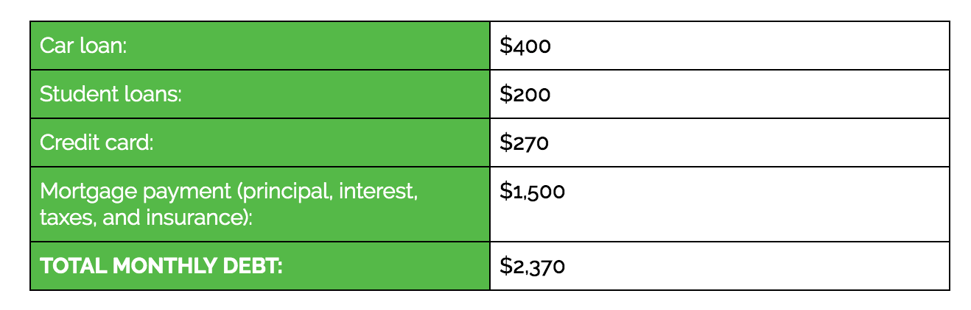

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular payments. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

If you have a salary of 72000 per year then your usable income for purposes of calculating.

Debt To Income Ratio Too High Find My Way Home

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Mortgage Payment

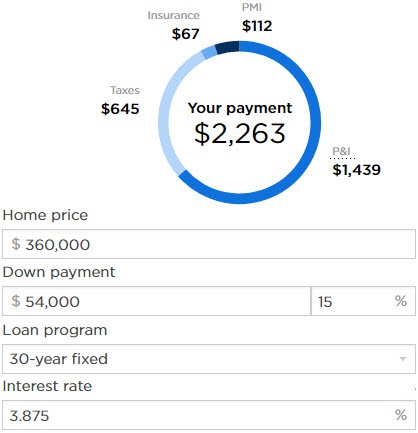

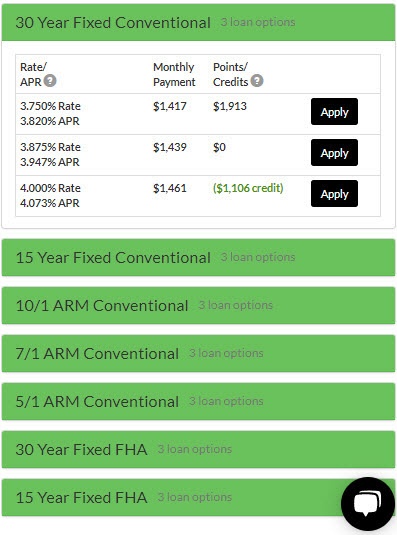

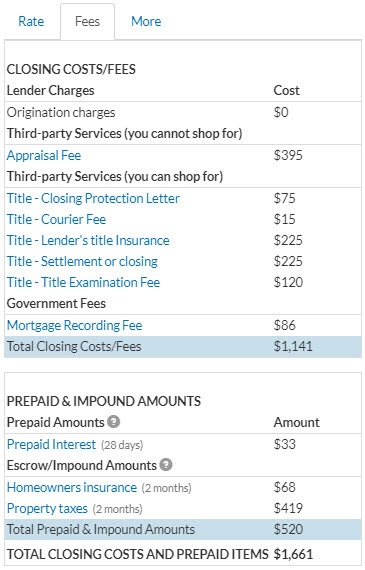

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How Self Employed Workers Get Mortgages

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How Lenders Calculate Qualifying Income Find My Way Home

How Self Employed Workers Get Mortgages

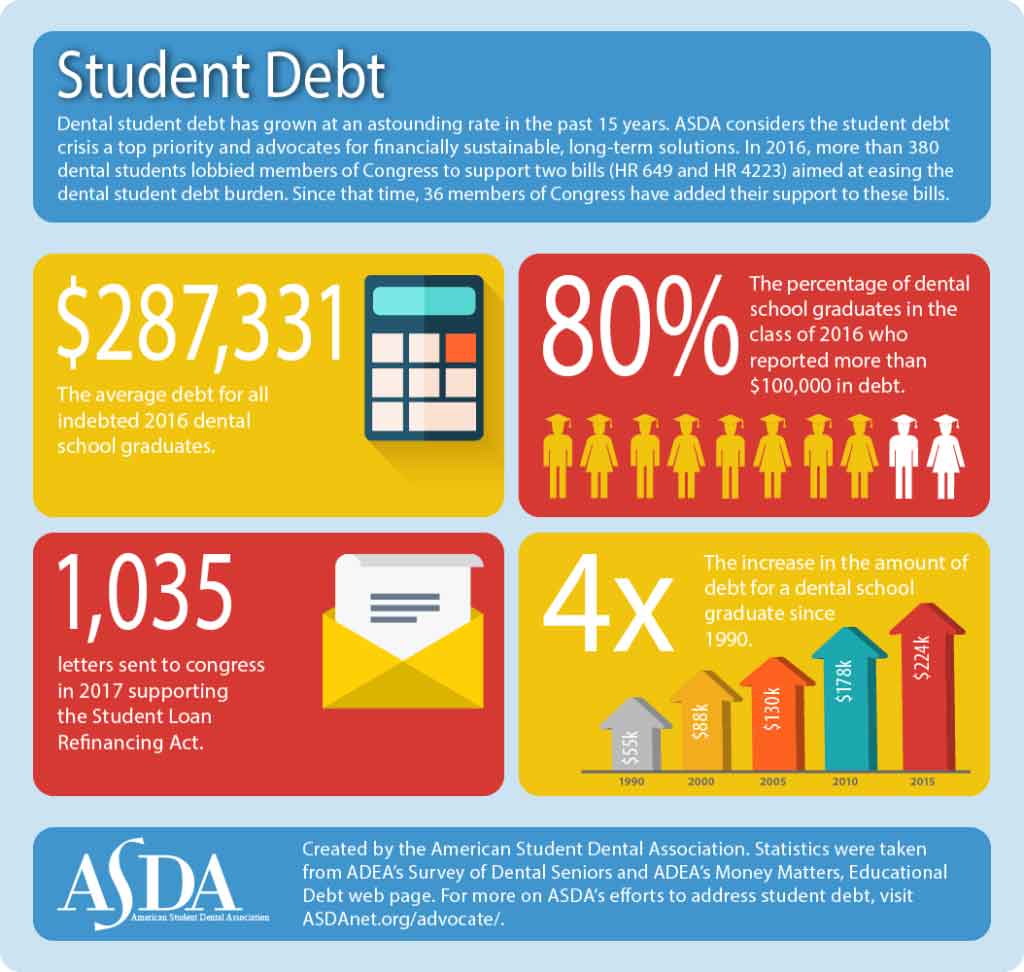

Dave Ramsey Mortgage Advice Should You Buy A House With Student Loans Debt Free Doctor

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

11 566 Ratio Photos Free Royalty Free Stock Photos From Dreamstime

2022 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

How To Get A Reliable Mortgage Rate Quote In 1 Minute

How A Mortgage Cosigner Can Help You Get Approved For A Home Loan

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt